An analysis of the New York State Association of Counties concludes that the release of the 4th quarter sales tax data shows continued retail stagnation for most counties across the state, and calls the comparison to 2014 receipts “troubling.”

According to information released by the New York State Tax Department, Yates County’s sales tax revenue in 2015 totaled $10,933,499, compared to $10,925,943 in 2014. County legislators had adopted a spending plan for 2015 that included an expectation of $10,800,000 in sales tax receipts. That means only $133,499 was put into the county’s general fund to go toward future expenses.

Legislative Chairman Timothy Dennis says as county officials look at all the final numbers for 2015, and because other areas of the budget look better, the sales tax decline won’t have as big an influence as it could. He explains, “The sales tax was remarkably close to the budgeted revenue. Those projections are based on previous year’s revenues and an estimate of the activity for the next year. When you take into account that we were down around $300,000 due to the decrease in the retail price of motor fuels, the rest of the activity showed a healthy increase. We are just now closing out the accounts for 2015 and will have a look at the effect on the fund balance. We had some other areas come out better than expected and I expect the fund balance will be OK.”

Historically, Yates County officials have projected sales tax receipts at a level that gave them some funds to set aside to help reduce the impact of spending increases on the next year’s local property tax levy.

In 2014, the county took in $625,943 more than had been expected. The budget projected revenue of $10.3 million and actual receipts were over $10.9 million. That money went into the general fund, and helped ensure that nearly $740,000 was available to help reduce the local property tax levy for 2015.

The 2016 Yates County budget includes a projection of $11 million in local sales tax revenue, and by the time work begins on the 2017 budget this fall, Treasurer/Budget Officer Nonie Flynn will have a more clear idea if the revenue stream is on target.

County officials could feel a squeeze if the sales tax revenues fall short of $11 million because of the recent use of fund balance to offset property tax levy increases — a strategy driven by Gov. Andrew Cuomo’s tax cap system.

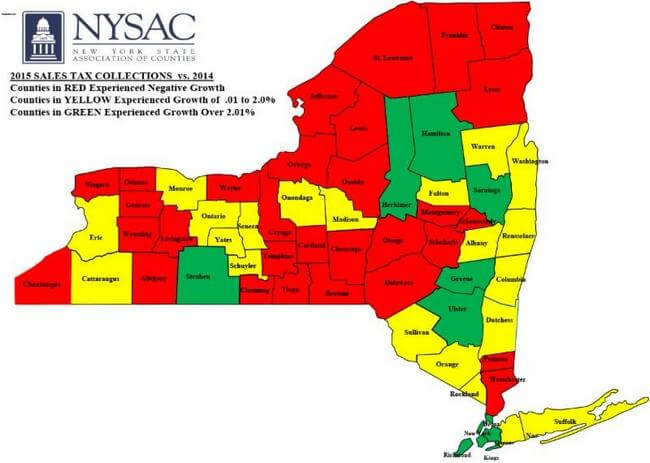

Statewide, 29 counties saw declines in sales tax revenue in 2015, making the average change per county a reduction of 0.3 percent.

Steuben County realized an increase of 9.5 percent or almost $4.5 million, the largest growth in a county statewide. Yates, Ontario, Schuyler, Seneca, and Monroe experienced growth between .01 percent to 2 percent.

Flynn says that increase in Steuben County is a reflection of a change in how sales taxes are distributed to cities. In previous years, the citys of Corning and Hornell received 50 percent of the revenues collected within their boundaries directly from the state. Now, that amount is included in the county’s payment from the state. Discounting those funds, Steuben County’s revenues were actually flat, she says.

Schuyler County officials say their increase was likely due to ticket sales for the Phish concert held at Watkins Glen International last summer.

Livingston, Wayne, Cayuga, Tompkins, and Chemung Counties experienced negative growth.

Montgomery County’s revenue declined by 6.7 percent or nearly $2 million

In the 4th quarter of 2015, 31 counties experienced negative growth in sales tax receipts when compared to the same time period in 2014. The state’s share of sales tax receipts declined by 2.3 percent in the 4th quarter of 2015 compared to 2014.

“This is most troubling because the fourth quarter includes holiday sales, which traditionally boost sales tax revenues across the board,” said New York State Association of Counties (NYSAC) President William Cherry, the Schoharie County Treasurer.

For all of 2015 compared to 2014, 30 counties experienced negative growth in sales tax receipts – with the average change per county down .3 percent. New York City, meanwhile, did quite well in both the 4th quarter (+17 percent) of 2015 and for the full year +7.3 percent.

In 2015, 12 counties collected less in sales tax revenue than they did in 2013. For 11 other counties, while not negative, they averaged less than 1% growth per year in sales tax receipts between 2013 and 2015.

Yates County’s 2013 budget projected revenue of $10.1 million, and actual receipts were over $10.6 million, putting nearly $509,617 into the county’s general fund.

In 2012, the general fund grew by $832,510 in extra sales tax income, and in 2011, an extra $798,796 was collected.

Source: http://www.chronicle-express.com/article/20160209/NEWS/160209776